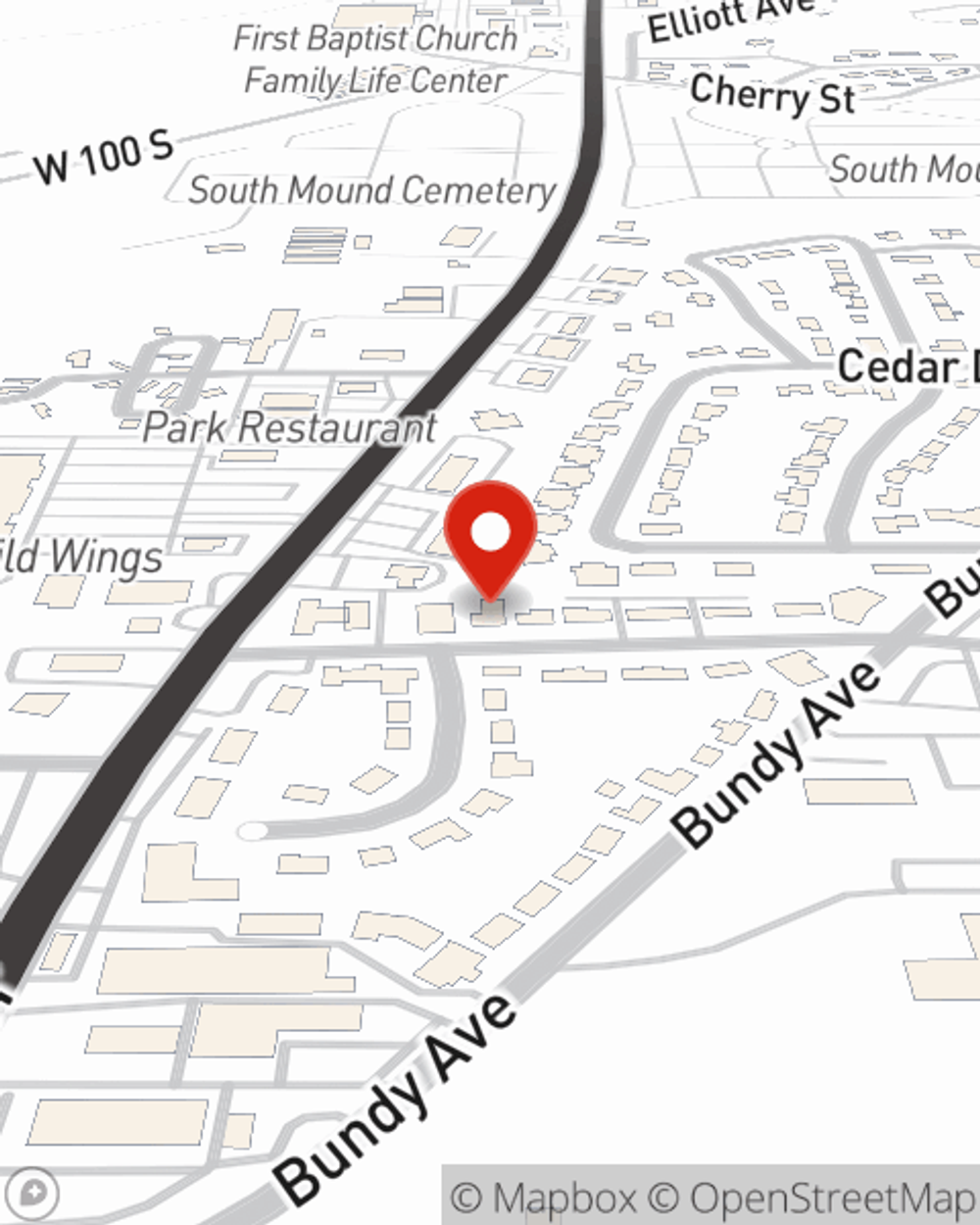

Business Insurance in and around New Castle

One of the top small business insurance companies in New Castle, and beyond.

Helping insure businesses can be the neighborly thing to do

- Hagerstown

- Cambridge City

- Knightstown

- Middletown

- Greenfield

- Muncie

- Yorktown

- Henry County

- Delaware County

- Madison County

- Fayette County

- Wayne County

- Hancock County

- Rush County

Your Search For Remarkable Small Business Insurance Ends Now.

Worries are unavoidable when you own a small business. You want to make sure your business and everyone connected to it are covered in the event of some unexpected damage or accident. And you also want to care for any staff and customers who stumble and fall on your property.

One of the top small business insurance companies in New Castle, and beyond.

Helping insure businesses can be the neighborly thing to do

Insurance Designed For Small Business

The unexpected is, well, unexpected, but it's better to expect it so that you're prepared. State Farm has a wide range of coverages, like business continuity plans or worker's compensation for your employees, that can be formed to develop a customized policy to fit your small business's needs. And when the unexpected does arise, agent Doug Meier can also help you file your claim.

Don’t let fears about your business keep you up at night! Visit State Farm agent Doug Meier today, and find out how you can benefit from State Farm small business insurance.

Simple Insights®

How to spot a roof leak and what to do if you have one

How to spot a roof leak and what to do if you have one

From mold on the roof to missing shingles, learn how to find roof leaks and know what to do.

How to hire employees for small business

How to hire employees for small business

Discover helpful strategies on how to hire skilled employees for your small business and learn how to attract and retain the right talent for your growing company.

Doug Meier

State Farm® Insurance AgentSimple Insights®

How to spot a roof leak and what to do if you have one

How to spot a roof leak and what to do if you have one

From mold on the roof to missing shingles, learn how to find roof leaks and know what to do.

How to hire employees for small business

How to hire employees for small business

Discover helpful strategies on how to hire skilled employees for your small business and learn how to attract and retain the right talent for your growing company.